Imagine Acquisition for Jupiter | Devjeet

Make saving, investing, and UPI fun with Jupiter

We are all familiar with:

Every time!

🏦 The traditional banking system has always been characterized by bureaucratic processes, cumbersome paperwork, and inefficiencies, leading to a disjointed user experience.

Customers often have to jump multiple counters, endure lengthy procedures, and grapple with extensive verifications, even for straightforward services like online banking enrollment or applying for a debit card. This not only compromises user convenience but also impedes the seamless integration of banking into daily life.

Being a professional, it becomes so hard to keep a track of all your expenses!! You can't keep up excel sheets forever!!

What if there was a streamlined, user-centric solution, 100% digital, that overcomes these barriers and brings banking into the digital age? What if there was an app where I could do all money-related activities?

The Product

We bring you the Jupiter Money app - 1 App for Everything Money!

Save, Invest, Pay, and Track from one application!

With Jupiter, you can create an online savings account within minutes - no paperwork needed at all!

Internet First Product | Yes |

Revenue Stats | Achieved PMF, Currently Series C funded (raise $160 million) |

Repeated Usage Frequency | High |

Interest | Yes |

Familiarity | Popular among youth |

Willingness to Pay | Yes, Jupiter recorded ₹19.3 crore revenue in the financial year 2022 |

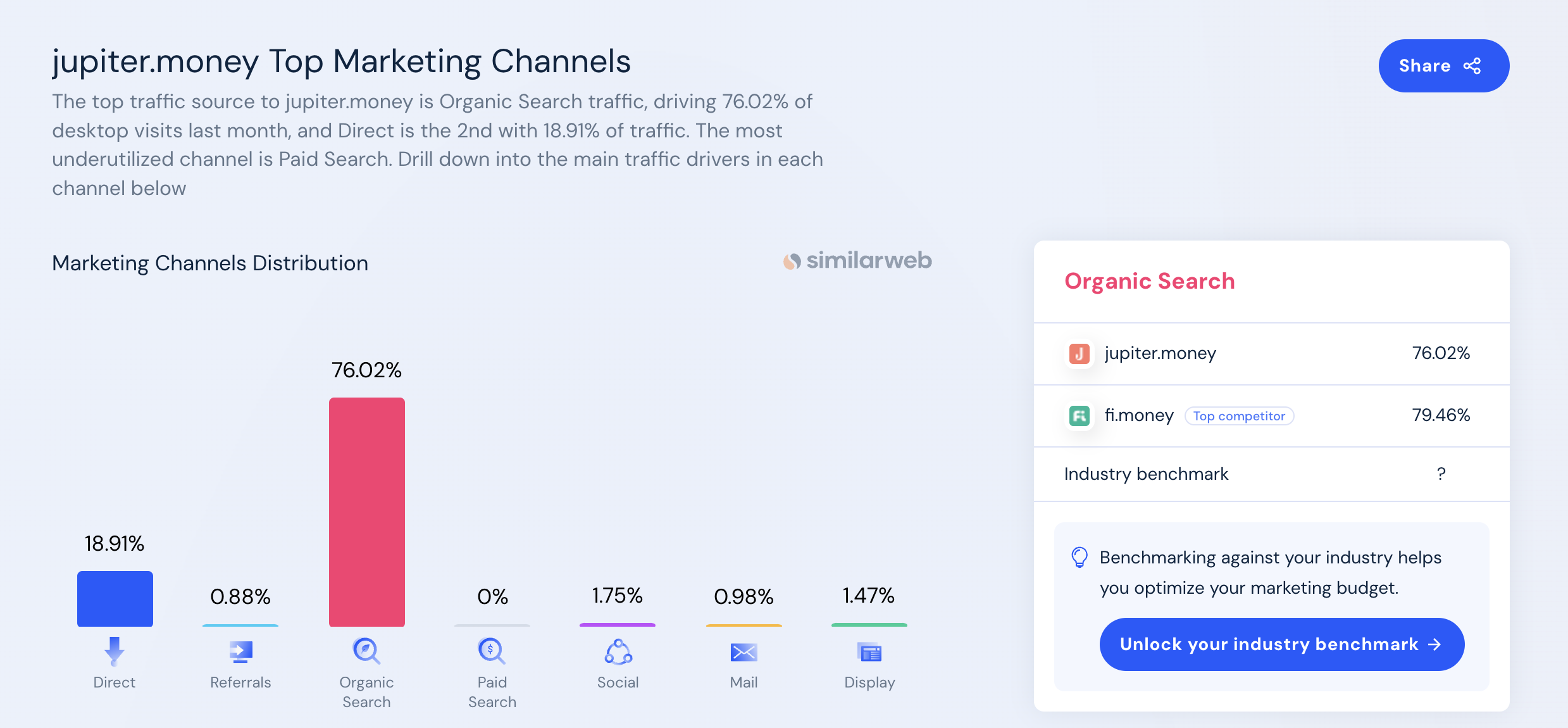

Bragworthy | Yes, Direct & Organic channels yield the most distribution |

Jupiter’s main value proposition is divided into three categories:

→ 🧾 Payments: Use Jupiter to pay to shop, friend, etc, and get exciting rewards - a seamless transaction experience.

→ 💰 Money Management: Track all your monthly expenses and get insights

→ 💸 Investment: Invest in mutual funds, SIPs, FDs, and Gold from the application - check your networth instantly.

It provides users a single platform to carry on all money-related to pay activities.

ICPs

Based on user interviews →

Questionnaire | Information | Structured Rhea | Explorer Archit | Picky- Abhishek | Pro - Vedant | Explorer - Apoorv | Lazy Anushka |

Demography | Age | 20-25 | 20-25 | 30-35 | 20-25 | 25-30 | 20-25 |

Gender | Female | Male | Male | Male | Male | Female | |

Married | Unmarried | Unmarried | Married | Unmarried | Unmarried | Unmarried | |

Kids | No | No | No | No | No | No | |

Occupation | Marketer | Financial Analyst | Marketing and Content | Product Manager | CFA/ Investment banker | Product Manager | |

City | Bangalore | Bhopal | Mumbai | Bangalore | Ahmedabad | Bangalore | |

Lives with? | Flatmates | Family | Family | Flatmates | Flatmates | Flatmates | |

Income range | 20-25 LPA | 15-20 LPA | 30+ LPA | 20-25 LPA | 20-25 LPA | 15-20 LPA | |

Education Level | Undergrad | Undergrad | Post Grad | Undergrad | CFA | Undergrad | |

Time spent. Where does users time go? | Where do they spend time? | Instagram, YouTube, Spotify, reading (non-fiction), playing with Cat | Instagram, Spotify, LinkedIn, Zerodha | Twitter, money control, youtube, bookmyshow, swiggy (instamart) and zepto, makemytrip, spotify, ICICI, Zerodha, iMobile, whatsapp | YouTube, LinkedIn, spend time on smallcase and Kite, WhatsApp, Spotify | LinkedIn, Google Search, Google Maps, Wordle, Camera, Instagram (not much), F1, reading, chess | Instagram, Kite, CultFit, LinkedIn |

Content they consume online | Self help content | Memes, Financial content | Highly active on Twitter, content around finance | Finance, building tech products, case studies | Latest news and happenings in Finance and technology startups | Creative content on YouTube mainly | |

Understanding users saving and investment behaviour | What all apps do you use for payments? | Cred, Google Pay, Jupiter | Google Pay, Phone Pe, Jupiter, Cred | Paytm, Google Pay, Cred | - PhonePe, | Cred, Google Pay | Google Pay, Paytm |

What is the most important factors while deciding which app to invest from? | - Trust - Rewards/ less fees | - Trust - Need better offerings | - Good will in the market - Single offering | - Good content - Ease of use | - Trust with one offering before start investing | - My friends/ peers must use the application | |

What all apps do you use for tracking your money? | Nothing | Jupiter | Have other apps, sheets | Fold Money - same as Jupiter Axios - grabs information from message | Excel | I don’t track my expenses | |

User Insights on Product | How did you discover Jupiter? | Instagram Ads, free money (neo banking - one card) | Instagram ads (jewels) - 2021 | Similar apps like Cred | Jupiter - Swadesh capital (refer) - 2020 | Saw an ad on Instagram/ LinkedIn | refer (cashback were really cool) |

Are you an active user? | Yes | Yes | No | Yes (Pro) - Account - I like the expense tracker - Pods (not like keeping it one place) - like to try all the apps ( and what experiences) - clean experience | No | No | |

Out of investing, payments, and money management - what is the main offering do you use Jupiter for? | UPI (for low value order transactions) and Investments | UPI and Money management | UPI | - Invested in els / tax deadline - Pods are save investments (liquid funds) - Salt too but didn’t go through - Used to use UPI, cashbacks Jewels was really high at one point - failed transactions - small transactions | UPI | UPI | |

What will motivate you to start investing through Jupiter? | More offers/ rewards | Need to build more trust | Focus on single core value proposition Currently, it offers so many features (not able to build trust) | Content plays an important role for me - built trust on the basis of it | Spend more time on the app with one feature will motivate me to invest with Jupiter. I like how cred focused to build trust using one core feature then offered me more features) | My friends should use them | |

Have you used on-demand salary feature? | No | No | No | Not yet, lending feature | No | No | |

Have you ever referred to someone? | No (the referral is not good) | Yes | No | 2 people -via applications - WOM - not able to track properly | No | Yes | |

What do you not like about Jupiter? | -UX can be better- its too much (so many features gets mixed) - offers aren’t really good anymore - earlier 1 jewel = Rs 1 but now changed the conversion to 5 jewel = Rs 1 | - these days the transaction fails a lot. - have reduced using it | Haven’t used much but i don’t like it pushing all the features at once | - diversify (horizontal) - started feeling cluttered - transactions failed as payments | - too many features - need to build trust with using only one feature i.e. payments | Rewards/ offers aren’t really good as they were before | |

Did you use the debit card? | No | Yes | No | Yes | No | Yes |

Summary:

💻 Structured Rhea:

- Uses Jupiter for payments and investments

- Uses different payments apps based on the offers provided

- Jupiter for low value transactions (groceries/ cab rides)

- Likes no fees for investing in mutual funds on Jupiter

- Loved jewels and can refer if the perks are improved

🧭 Explorer Archit:

- Uses Jupiter for all payments

- Likes to track expenses at the end of the month

- Need to build more trust in order to start investing

- Need more benefits on the application to switch from a competitor

🧐 Picky Abhishek:

- New to the app - still exploring features

- Likes to research well and understand before using the features

- Has specific applications for investments, tracking, and payments.

- Is not motivated by jewels

🧭 Explorer Apoorv:

- New to the app - has explored payment features

- Might invest once trust is build through one offering (payments)

- Has alternative apps for all use cases provided for Jupiter

- Can switch if knows the core feature

🥱 Lazy Anushka:

- Driven by peers and friends

- Haven’t explored features yet

- Once uninstalled Jupiter to make free space in phone

- Need offerings and rewards for every payment

🧠 Pro Vedant:

- Value focused and loves to explore different apps

- Paid user of Jupiter

- Have been using the application since 2020

- An active users and have used all features

🎯 Applying ICP Prioritisation Framework:

ICPs | Adoption Curve | Frequency | Appetite to Pay | TAM | Distibution Potential |

Structured Rhea | High | Medium | High | High | High |

Explorer Archit | High | Medium | Medium | High | Medium |

Picky Abhishek | Low | Low | High | Medium | Low |

Explorer Apoorv | Medium | Medium | High | High | Medium |

Lazy Anushka | Medium | Medium | High | High | Low |

Pro Vedant | High | High | High | High | High |

Prioritising: Pro Vedant (P1) and Structured Rhea (P2)

Jupiter Money with it’s multiple offerings might overwhelm new users like Pro Abhishek who like to use different applications for different utilities/ features and research well on the offerings. While Pro Apoorv might become an active user if trust is built with one feature initially i.e, payments. On the other hand, Lazy Anushka is clearly driven by her peers and doesn’t use an app without her friends recommending her.

Thus, Pro Vedant and Structured Rhea are ideal personas who are currently active users and with better tailored offerings - will use the application more and spread a good WOM.

Also, audience demographics on the current website tell us that people who fall in the age category of 18-35 cover more than 50% of traffic.

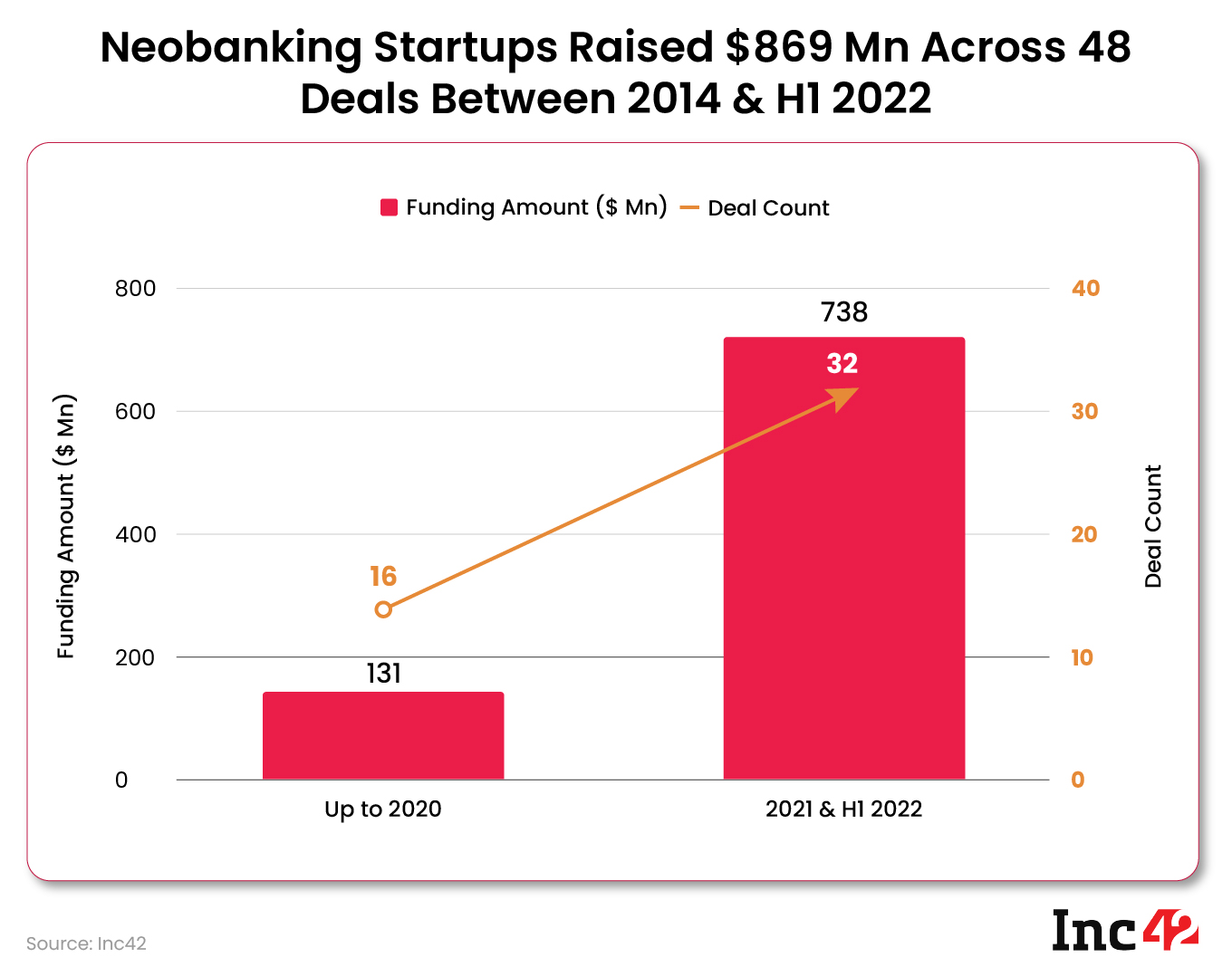

📈 Market (TAM/ SAM/ SOM)

The market for neo-banks is growing tremendously in India. According to Source the market will reach $180 billion by 2030!

Market research + Top down approach:

TAM:

TAM | Numbers | |

Indian population | 1400 millions | |

Population with access to internet | 760 million | Source (https://economictimes.indiatimes.com/tech/technology/52-of-indian-population-had-internet-access-in-2022-says-report/articleshow/99964704.cms) |

Urban Population | 360 million | Source (https://www.moneycontrol.com/news/business/internet-users-in-india-set-to-reach-900-million-by-2025-report-10522311.html) |

Urban Population who fall under 18-35 age group | 1/3 * 360 million = 120 million | |

People who use UPI | 80% * 120 million = 96 million | Source (https://www.cnbctv18.com/technology/upi-transactions-payments-10-billion-for-first-time-in-august-digital-npci-17692301.htm) |

Youth interested in Personal financial management tools | 20% * 96 million = 19.2 million | Source (https://www.cnbctv18.com/technology/upi-transactions-payments-10-billion-for-first-time-in-august-digital-npci-17692301.htm) |

TAM | 19.2 million |

SAM:

Assuming with Jupiter’s reach and services - it can reach 50% of the TAM we calculated so →

SAM (Calculation) | Numbers | |

TAM | 19.2 million | |

Market penetration | 50% | Assumption |

SAM | 9.6 million |

SOM:

Jupiter already has 2.2 million users, If Jupiter's market strategies are aggressive and the competition is not overly intense, they might aim to capture a significant portion of the SAM over the next few years. Let's say they target a 25% share of the SAM as their SOM.

SOM (Calculation) | Numbers |

TAM | 19.2 million |

Target Market Share | 25% |

SOM | 2.4 million |

🏃🏼 Acquisition Channel Selection:

Based on the current stats and research on Jupiter, it’s in mature scaling stage.

→ Multiple channel partners

→ Referral

→ Organic channel

Applying Channel Selection Framework:

Channel name | Cost | Flexibility | Effort | Speed | Lead Time | Scale |

Organic | Low | Low | High | High | Medium | Medium |

Referrals | Low | Medium | Medium | Medium | High | High |

Paid Ads | High | High | Medium | High | Low | High |

Product Integrations | Medium | Low | High | Medium | Medium | Low |

Diving deep into each channel:

- ❌ Organic: The current efforts of Jupiter has helped to get 76.02% traffic on Jupiter.money through organic searches. But it’s only helping to fulfill and not creating an intent to use the application. It’s creating a lot of Push and not pull. Thus, i am not preferring organic. However content marketing efforts have produced 40-42 percent of its new customers. Especially efforts in Social media content.

- Branded keywords: The volume is low. (Exception Jupiter Planet)

- Non branded keywords:

Community feature: I pretty much like the community feature - where users can post about feedback and get involved with other users. Users like Pro Abhishek and Pro Apoorv who are very particular about finance platforms can be encouraged to check out the community forum for useful information and build trust.

Community feature: I pretty much like the community feature - where users can post about feedback and get involved with other users. Users like Pro Abhishek and Pro Apoorv who are very particular about finance platforms can be encouraged to check out the community forum for useful information and build trust.

- ✅ Referrals: Only 2/6 ICPs had downloaded the app after someone referred. But I still feel optimising this channel will give a leverage to Jupiter in getting more users. Restructuring the incentive program and giving better rewards will push people to refer to their friends. Talking with Pro Vedant who has referred to 2 people told that the referral wasn’t visible much.

- Saw on the community posts too →

- ✅ Paid Ads: Out of 3/6 ICPs discovered the application through Ads and specifically Instagram ads. They were able to connect well with the application that pushed them to use Jupiter. Although the costs are high but I strongly feel it will help to convey about Jupiter well and acquire new users to the application. Once delighted - it gives a good chance for them to refer further to their friends.

- ❌ Product Integrations: Partnering up with more banks will give users more options to track and invest money. Currently, Jupiter has currently partnered with →

Products on our Platform | Role of Partner |

Bank and Deposit Accounts | AFTPL through its brand Jupiter has partnered with Federal bank to offer Savings Bank accounts, Fixed and Recurring Deposits to consumers. |

Cards | AFTPL through its brand Jupiter is a marketplace for co-branded cards promoted by Europa Neo Marketing Pvt Ltd in partnership with Federal Bank. |

On Demand Salary | AFTPL through its brand Jupiter has partnered with Trillionloans Fintech Private Limited, Amica Finance Private Limited, Kisetsu Saison Finance (India) Private Limited to provide lending products to consumers |

Mutual Funds | AFTPL through its brand Jupiter has partnered with AIAPL to provide mutual funds to consumers |

Digital Gold | AFTPL through its brand Jupiter has partnered with MMTC-PAMP to provide Digital Gold products to consumers. |

Health Insurance | AFTPL through its brand Jupiter has partnered with Onsurity to provide Health Insurance Products to consumers. |

Gift Cards | AFTPL through its brand Jupiter has partnered with Pine Labs to provide Pre Paid Gift Card Products to consumers. |

Though, product integrations will help to build more trust but the scale is not that much. Thus, I won’t prefer product integrations as a priority channel.

🤑 Diving deep into Paid Ads!

Currently, the Instagram page with over 30k followers →

- UGC is not actively posted

- Tho, they have recently started talking to users on street in the occassion of Halloween (which is a very popular way of getting views these days)

- Mostly feature promotions but synced with target audience

And YouTube channel with over 40k subscribers→

- Not active lately

- The last series of videos were posted a long time ago

Surely, they are missing out an opportunity when it comes to YouTube. Finance is one of the hot topics currently and Jupiter can create really good content around there core features that help people better manage their money.

I saw some of the Fintech influencers like Finance with Sharan posted about Jupiter. Similar efforts can result can help in acquiring new users.

LinkedIn has over 70k followers.

- Posts related to company culture and

- It’s good to have a strong presence on LinkedIn as most professionals (urban 18-35) use LinkedIn every day.

- Good for posting announcements related to products easily

- But the reach has not been good for individual posts

- LinkedIn keeps on experimenting with algorithms

Twitter has the highest following of 117.6k followers.

- Audience is targeted well

- But one mis aligned post on Twitter might trigger a lot of people

- Tweets are related to current happenings and product related posts

Channel Selection Framework:

Channel name | Cost | Flexibility | Effort | Speed | Scale | Budget |

Google Ads | High | Medium | Medium | Medium | High | Medium |

YouTube | Medium | High | High | Medium | High | High |

Medium | High | Medium | High | High | Medium | |

Medium | High | Low | High | High | Medium | |

Medium | High | Medium | Medium | Medium | Medium |

Based on the interviews with customers,

✅ Instagram has been one of the platforms that has worked well to discover about Jupiter Money app. Targeting the right audience with a good campaign can help people know about an app like Jupiter. Instagram can also work on medium budget ad and refine based on the target audience.

❌ YouTube Ads might be costly compared to the competitiveness and requires more budget for producing a high quality content. However organic efforts like starting a podcast and posting YouTube shorts consistently can help to gain new eye balls/ acquire new customers.

❌ Google Ads for a space like Neo Banking is still pretty new. Based on the research on keywords, mostly branded keywords have worked well for us. For keywords like “Investing”, “Saving”, “Money tracker” the Cost per click is usually super high.

✅ LinkedIn Ads might work well as based on the prioritised ICPs, they are active on LinkedIn. LinkedIn ads don’t require much efforts cause all formats work well.

❌ Twitter Ads are quite expensive and might not appeal to many people. In general, audience on Twitter likes to critique and seeing an ad on Twitter feed won’t give a good impression for an app like Jupiter that has to build trust with the user. Organic growth will be highly preferred on Twitter.

Calculating CAC: LTV

Looking into different ways, Jupiter makes money:

- Subscriptions

- Pro (Rs 15,000/ year)

- Alary (Rs 45,000/ year)

- Commissions

- When a customer uses a debit card, takes out a loan, or buys an insurance policy through its platform.

For LTV, looked at total revenue for a year and divided by the data on customers ~ 2,000,000

Using, CAC = $6 (Rs 640) [Source](https://www.moneymanagementindia.net/jupiter/#:~:text=He stated that Jupiter's CAC,for the survival of neobanks.)

LTV= ARPU × GrossMargin × Retention x Frequency

Yearly Revenue (2022) | INR 19 Crores Source |

Total Users | 2,000,000 |

ARPU | 95 |

Gross Margin | 40% |

Retention | 6 |

Frequency | 15 |

LTV | 3420 |

CAC:LTV = 640:3420 = 1:5.5

Thus, it’s alright to go for paid channels and acquire customers through Ads.

Ad Objective:

Focused on people like Pro Vedant - who are actively looking at options to manage their money.

- Primary Objective: Encourage downloads and active use of the Jupiter Money app by highlighting its money management features, such as budget tracking, saving goals, and spending analytics.

- Secondary Objective: Increase brand awareness and position Jupiter Money as a go-to app for financial literacy and independence within the young adult demographic.

Campaign Title: "Master Your Money with Jupiter Money"

Target Audience:

- Age Group: 20-25

- Interests: Personal finance, money management, saving, budgeting

- Lifestyle: Young professionals, early-career individuals, tech-savvy and active on social media, possibly new to financial independence.

Creative Strategy:

- Visuals: Here is a sample creative-

- Additionally →

- Create carousel ads that walk through the money management process with the app.

- Include user interface snippets that highlight how easy it is to set up and use the app’s budgeting and saving features.

- Copy:

- Conversational and motivating text that speaks directly to the aspirations of young adults wanting to take control of their finances.

- Phrases like “Take charge of your cash”, “Budget like a boss”, or “Save for what matters” can resonate with the target demographic.

- A clear call to action, such as “Get Started”, “Download Now”, or “Take Control Today”.

- Hashtags:

- Utilize popular finance-related hashtags and create a campaign-specific hashtag like #MoneyMastered or #JupiterMoneyMagic.

- Incentives:

- Offer an exclusive feature unlock or a promotional offer for users who download the app through the Instagram campaign.

- Influencer Partnership:

- Collaborate with influencers like Finance with Sharan, Ankur Warikoo who are known for smart money habits or financial advice to leverage their trust with the audience.

Ad Placement:

- Use Instagram Stories with interactive features like polls asking about money habits, with a “Swipe Up to Manage Better” CTA.

- Feed ads for broader reach, with a focus on showcasing the app’s features.

Measurement & Optimization:

- Utilize Instagram’s ad performance metrics to measure app installs, engagement, and interaction with the app’s features prompted by the ads.

- Regularly refine targeting based on engagement patterns and feedback received in comments and direct messages.

Budget Considerations:

- Initial Testing Phase: Allocate a small portion of the budget to test different ad creatives and messaging. This could be around 10-20% of the total budget.

- Scaling Phase: Once the most effective ads are identified, scale up by allocating the majority of the budget to the highest performing ads.

- Continuous Optimization: Reserve a portion of the budget for ongoing optimization, A/B testing, and refining the campaign based on analytics and performance data.

Sample Budget Breakdown:

- Testing Budget: $1,000 - $2,000

- Main Campaign Budget: $8,000 - $18,000

- Optimization and Retargeting Budget: $1,000 - $2,000

- Total Budget: $10,000 - $22,000

🗣️ Diving deep into Referral Design!

Brag worthy factor is how you can track your expenses and at the same time see your networth.

Tell your friends about different Pots to invest in to grow your money and get Jewels for inviting your friend on the application.

- Get rewards for improving your financial habits

- Auto categorisation of expenses

Prioritising Pro Vedant and Structured Rhea →

The platform currency is Jewels!

- Users get jewels for every successful referral.

- The value of 5 Jewels = INR 1

- Earlier it was 1 Jewel = INR 1

- This has upset early users like Pro Vedant and Structured Rhea, who enjoyed getting good cashback and suddenly faced a reduction in rewards that pushed them to slow down the activity on Jupiter.

- Cashbacks/ rewards are in the form of Jewels

- Earn up to 6,000 Jewels using Jupiter's debit card

- Upto 100 Jewels while paying through Jupiter Money app

- Pro members earn more Jewels compared to a normal user

Prioritising 2 user stories:

- Pro Vedant who uses it for investing and expense tracker

- Structured Rhea who uses it for payments

Here is the current referral flow for Jupiter:

Step 1:

- A user can scroll down on the homepage

- Sees a banner to refer and earn

- A user can click on rewards on the top navigation bar to see refer option

- Sees a button and a banner to refer

Step 2:

Once a user clicks on “Refer” banner/ button →

- Redirected to a new screen

- Refer and win

- Can see all the offers

- Invite through “Whatsapp” or copy the link of the invite code

- Can also sync contacts to send invite link

Step 3:

After pressing “Invite via WhatsApp” button →

- User can modify the message

- And send their contacts on WhatsApp

Step 4:

Post sending the invites:

- Track individual referral and the progress they have made in the application

- Remind them

✅ What's right:

- Placement of referrals

- In the form of a banner at the end of the homepage

- Inside Rewards

- Tracker of users who have been invited

- Users who refer to more than 3 people can get a luxury travel membership worth Rs 50,000

💡 What can be improved:

- Better rewards on successful referral

- Better tracker for people to track invites

- A progress bar would really look good for people to encourage them to refer more people

- Invite message

- It can be shortened to something more catchy and with an appealing graphic

- For users like Pro Vedant who use Pots and love it - asking for a referral post-investing will work really well!

- For users like Structured Rhea who are on Jupiter for payments - more rewards should be pushed after a successful payment - in the form of platform currency to motivate them about referring.

- Currently, 5Jewels = Rs 1 which can be made more competitive to showcase better rewards to encourage people promote the application and use

Modified referral tracker might look like this:

Updated the tracker for people like Pro Vedant - who want more visuals to track and see how many people need to be invited.

Changes:

- Made the next reward more visible based on the existing referrals

- Added a tracker on the right that shows how many referrals are left to unlock the travel membership

- And shifted the invite tracker below

by Devjeet Choudhury

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.